Is Addison’s disease affecting your ability to buy competitive life insurance?

Understanding Addison’s Disease

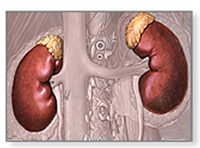

As mentioned, Addison’s disease is a hormonal disorder and occurs when the adrenal glands do not produce enough of the hormone cortisol and in some cases the hormone aldosterone. Located above each kidney, the adrenal glands are small hormone-secreting organs consisting of the outer portion (called the cortex) and the inner portion (called the medulla). Addison’s disease results from damage to the adrenal cortex that consequently limits the production of these important hormones.

Cortisol is thought to affect the body in many different ways but its most important job is to help the body respond to stress. Other benefits of cortisol include helping to maintain blood pressure and cardiovascular functions as well as regulating the metabolism of proteins, carbohydrates, and fats. When the level of cortisol is out of balance, the body does not react in a normal fashion and will likely experience chronic fatigue, muscle weakness and loss of appetite.

Aldosterone is also very important as it helps maintain blood pressure as well as water and salt balance in the body by helping the kidney retain sodium and excrete potassium. When the body fails to produce adequate levels of aldosterone, the kidneys do not properly regulate salt and water levels, causing blood volume and blood pressure to drop. The result is fatigue and weight loss and in half of the cases nausea, vomiting and diarrhea will also be present.

Addison’s disease can be caused by a number of factors. When first discovered by Dr. Thomas Addison in 1849, tuberculosis was found in over 70 percent of those who died from adrenal insufficiency. Today, roughly 60 percent of all reported cases are the result of autoimmune disorders with some specific types of Addison’s disease thought to be generic. Other causes may include chronic fungal infections, the use of blood thinning medications or the spreading of cancer cells to the adrenal glands resulting in surgical removal.

The term “Addisonian” is used to describe a person that is experiencing severe adrenal insufficiency. When a person is “Addisonian”, the condition can be fatal if treatment is not administered promptly.

Risk Factors of Addison’s Disease

The risk factors below may not be a direct cause of Addison’s disease, but can be associated with triggering its onset. Having one of these risk factors increases the likelihood of developing Addison’s but does not always lead to the condition. Also, the absence of the risk factors below does not prevent the onset of adrenal insufficiency. When considering an individual with Addison’s disease, life insurance companies will pay careful attention to these factors.

- Diabetes,

- Stress,

- Cancer,

- Bacterial and Fungal Infections,

- Surgery and some radiation treatments,

- Certain medications such as blood thinners.

The Impact of Addison’s Disease on Life Insurance Rates

A diagnosis of Addison’s disease is a serious health concern and therefore all insurance companies will consider its effect when underwriting for life insurance. As with any other medical ailment, the level of control of your condition will be the most important factor affecting your ability to get competitively priced life insurance. For most people, hormone replacement therapy via oral medications or injections is the only treatment required. If this is your case, and assuming proper medical compliance with your endocrinologist, you can expect to receive a standard or average rate for life insurance.

If your condition is unstable and is not effectively managed with medications or you have additional risk factors such as those mentioned above, you can expect to be charged a higher rate for life insurance. This would include those that have had multiple “Addisonian Events” requiring emergency room visits and hospitalizations. Your actual rates will depend upon the documented information in your medical records including physician’s notes and lab reports.

If your condition is considered severe or if you are noncompliant with medical follow up including routine physician visits, adequate use of medications and blood tests, you can expect to be declined for life insurance.

Term Life Insurance and Addisons Disease

At MEG Financial, we have worked with many individuals across the country that have had related histories and have helped many obtain fairly priced life insurance. A number of these clients previously attempted to buy life insurance elsewhere but were either turned down or asked to pay a significantly higher rate. Our experience helping others with related problems is invaluable to you in identifying the insurance company that will treat you most fairly.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over any questions or other concerns.

Speak with an experienced advisor!

Speak with an experienced advisor!