Is your recent diagnosis or history of atrial fibrillation affecting your ability to get a good rate for life Insurance?

Understanding Atrial Fibrillation (AF)

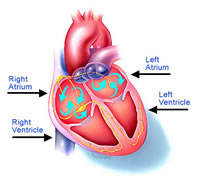

The normal pumping of the heart works on natural electrical impulses which begin in its two upper chambers called the atria. Atrial fibrillation occurs when these upper chambers quiver and contract rapidly in an uncoordinated way. When this occurs, the heart cannot pump blood efficiently which can have significant effects on blood pressure and the efficient movement of oxygen throughout your body sometimes resulting in strokes. Some causes of atrial fibrillation include high blood pressure, coronary artery disease, heart valve disease, chronic lung disease, heart failure and cardiomyopathy.

There are four basic classifications of atrial fibrillation: paroxysmal, persistent, permanent and lone. The specific diagnosis will be the chief factor in determining your actual rate for life insurance.

Paroxysmal (intermittent) Atrial Fibrillation. The episodes of AF generally last less than 7 days (usually less than 24 hours) and may be recurrent, which is defined as two or more episodes.

Persistent Atrial Fibrillation. The AF is consistent and not responsive unless treatment is performed such as medications or cardioversion. A cardioversion is a medical procedure that attempts to bring the heart back into its normal rhythm.

Permanent Atrial Fibrillation. The AF/arrhythmia lasts for more than one year and cardioversion has failed. Permanent AF is also referred to as chronic AF.

” Lone” Atrial Fibrillation. Can be paroxysmal, persistent, or permanent AF occurring in individuals without heart or lung disease who have a low risk for blood clots resulting in strokes or mortality. Lone AF is also known as low-risk AF.

Statistics on Atrial Fibrillation

- Atrial fibrillation isn’t life-threatening, but it can lead to other health problems such as heart disease or stroke.

- According to the American Heart Association, your chances of having a stroke are five times higher if you have AF and about 15–20 percent of all strokes occur in people with AF.

- Studies suggest that diagnosis of AF increases significantly with age especially past age 70 with roughly 1 in 10 having AF beyond the age of 80.

- Caucasian men are more likely to be diagnosed with AF than any other demographic.

- It is projected that by the year 2025, more than 3 million Americans will have atrial fibrillation.

Risk factors for Atrial Fibrillation

While most atrial fibrillation cases are stable and not significant threats to mortality, life insurance companies will look closely at the conditions surrounding each case. Below are some of the more important risk factors for those with AF.

- Age,

- Hypertension (High Blood Pressure),

- Congestive Heart Failure,

- Diabetes,

- Previous Heart Attacks,

- Past Heart Surgeries,

- History of Strokes,

- Excessive Alcohol Use, and

- Obesity.

The Impact of Atrial Fibrillation on Life Insurance Rates

The main focus for life insurance companies in evaluating the risk of Atrial Fibrillation is your level of control. Obviously, the better controlled your AF, the better your rate. Your “health class” for insurance purposes will depend on the specific information in your medical records including diagnostic tests such as EKG’s with particular emphasis on physician’s notes. Additionally, good compliant follow up with your medical professionals is critical allowing the insurance companies to accurately assess your risk and thereby giving you the best possible rate.

Individuals with Paroxysmal AF with no known heart disease can expect to qualify for a standard health class with and outside chance at preferred rates. This assumes that there is a single episode or only very few (2-3) AF instances throughout the year. The presence of a normal echocardiogram will help significantly in getting the standard rate.

If the number of AF episodes exceeds 10 per year then it is considered to be persistent or chronic AF. In these cases, with no underlying heart disease, you can expect to get a life insurance rate somewhere between 150% and 200% of the standard rate. If there is underlying heart disease, you can expect a significant extra charge and in most cases a decline of coverage.

Life insurance companies will decline someone with permanent atrial fibrillation.

Treatment can sometimes help correct the AF condition and insurance companies will consider any treatment if it is successful. When atrial fibrillation is found, sometimes medication or even electrical stimulation, known as cardioversion, is used to get the heart rhythm back to normal. If successful, and the condition is stable for a 6-12 month period, insurance companies will consider for standard health rates.

For more information on AF and life insurance underwriting see, important questions for individuals with atrial fibrillation that are seeking life insurance.

How Can the Insurance Professionals at MEG Financial Help?

At MEG Financial, we have helped many individuals with atrial fibrillation obtain fairly priced life insurance. Many of these clients had attempted to buy life insurance elsewhere but were either asked to pay a significantly higher rate or in some cases declined for insurance. Our experience helping others with health conditions such as atrial fibrillation will also be helpful to you in finding an insurance company that will treat you fairly.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over any questions or other concerns.

Speak with an experienced advisor!

Speak with an experienced advisor!