Is a history of arteriosclerosis affecting your ability to get a competitively priced life insurance policy? Learn more about arteriosclerosis / atherosclerosis and information on receiving a life insurance quote from our specialists.

Understanding Arteriosclerosis and Atherosclerosis

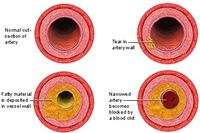

Arteriosclerosis, also referred to as atherosclerosis, is a slow gradually progressive disease that results in damage to the body’s arteries which may eventually affect blood circulation throughout the body. Over time, due to age and other factors, the inner walls of the arteries become progressively thicker and lose their normal elasticity. This normally occurs as a result of a build up of cholesterol or fatty deposits known as plaque. As plaque builds, it becomes hardened and further narrows the inner walls of the arteries which results in an insufficient flow of blood to the body’s organs. Plaque can also rupture causing blood clots to form that can block blood flow or break off and travel to another part of the body. If either happens and blocks a blood vessel that feeds the heart, it will result in a heart attack. If it blocks a blood vessel that feeds the brain, it will cause a stroke.

Atherosclerosis is often thought of as a heart problem but it can result in damage to arteries anywhere in your body. When arteries leading to your limbs are affected, you may develop circulation problems in your arms and legs called peripheral vascular disease. When arteries that supply blood to your brain are affected, you could have a transient ischemic attack (TIA) or stroke. It can also lead to a ballooning or rupture in the wall of your artery causing an aneurysm.

Other related medical conditions (or medical terminology) include Coronary Artery Disease, Blocked Arteries, Clogged Arteries, Stents, CAD, and Arrhythmias. Read below for more information on receiving a life insurance quote with these medical conditions.

Arteriosclerosis Facts

- Males and people with a family history of premature cardiovascular disease have an increased risk of atherosclerosis.

- In 2007, about 1.2 million Americans will have a first or recurrent coronary attack. Of these 1.2 million people about 452,000 will die.

- Coronary heart disease is the nation’s leading cause of death.

- About 7.9 million Americans 20 years and older have already had and survived a heart attack, and about 8.9 million have already experienced chest pain due to a reduced blood supply to the heart.

- Each year about 700,000 people in the United States will have their first or a recurrent stroke of these people 150,000 will die which makes stroke the third leading cause of death.

- Women will account for 6 in 10 stroke deaths.

Risk Factors for Atherolsclerosis

There are many potential contributors to the development of atherosclerosis. While some of these factors are genetic and therefore uncontrollable, the good news is that many risk factors are controllable if you make the right lifestyle choices. When evaluating someone with arteriosclerosis, life insurance companies are especially interested in the risk factors below.

Controllable Factors Include:

- High Cholesterol,

- High Triglycerides,

- High Blood Pressure,

- Cigarette Smoking,

- Diabetes,

- Excessive Build- Overweight,/li>

- Lack of Exercise,

- Poor Diet- High Fat Diet.

Uncontrollable Factors Include:

- Age,

- Gender,

- Family History

- Race.

The Impact of Arteriosclerosis on Life Insurance Rates

Atherosclerosis is a direct cause of heart attack, stroke and other life threatening conditions and will therefore be of serious concern to all life insurance companies. When underwriting for life insurance, companies will review your case based on the specific information contained in your medical file with special emphasis on lab work and diagnostics tests such as echocardiograms, angiograms, CT scans and EKG’s. Additionally, the presence of the risk factors listed above and any treatment such as coronary angioplasty will be major considerations in determining your rate for life insurance.

High cholesterol and triglycerides are known factors in causing atherosclerosis and are therefore important yardsticks when measuring the increase risk of potential heart disease. Specifically, low-density lipoprotein (LDL) or “bad cholesterol” is thought to increase the fatty deposits of plaque on the walls of the arteries. Therefore, a very high LDL number will be seen as a negative risk factor by life insurance companies. A normal reading for LDL would be anything less than 100 mg/dl.

Moderately elevated cholesterol alone will not significantly impact the rate you pay for life insurance. Most companies will still consider for a preferred health class with total cholesterol readings as high as 240 mg/dl. This obviously assumes there is no underlying heart disease.

Atherosclerosis is a form of coronary artery disease and is usually diagnosed after having a medical test such as an angiogram or echocardiogram. These tests will identify the level of plaque buildup, the percentage of arterial narrowing involved (stenosis) as well as the number of vessels affected. From the insurance company’s perspective, each of these variables will help determine the severity of the condition and its overall threat to mortality. From the physician’s perspective, these results can be used as a barometer for future maintenance as well as an indicator of a potential treatment strategy. See, Life Insurance Underwriting Versus Practical Medicine.

The level of plaque blockage along with the number of diseased vessels and their locations will be of critical importance to any life insurance company. If there is only one vessel involved and the blockage is in a favorable location, surgery such as angioplasty may be an effective solution. Angioplasty is a procedure whereby the artery is reopened by inserting a thin tube (catheter) with a balloon through the vessel and expanding the balloon in the affected area to widen the arterial wall. In some cases, stents are inserted to help prevent arteries from narrowing again in the future. For more information see, Angioplasty and Life Insurance.

If angioplasty has been used to successfully treat your arteriosclerosis, and assuming limited risk factors noted above, your life insurance policy will most likely be rated with a small extra charge. With only one or two vessels affected and no other underlying heart issues, you might qualify for life insurance at a standard rate depending on the insurance company but will likely be charged 25% to 50% more than the standard health class. Compliant medical follow up is also mandatory to getting the most favorable rate.

Those with chronic atherosclerosis requiring multiple angioplasties with stents or major surgical procedures such as a heart by-pass will pay significantly higher rates for life insurance. A best case scenario in these cases will likely be 50%- 200% more than the standard health rate. This assumes limited risk factors above and compliant medical follow up with a cardiologist.

If you have chronic atherosclerosis with multiple risk factors noted above you may pay rates in excess of 200% more than the standard rate. This includes individuals with several health concerns such as high blood pressure and diabetes along with coronary artery disease. With a combination of health problems, and depending on the stability of your overall health, you may have a hard time finding life insurance coverage at any rate.

In most cases, you may not realize that you have atherosclerosis until a blockage or hardened artery results in a serious health problem. However, the good news is that you can take steps now to protect yourself from future problems. Healthy lifestyle changes such as a better diet and regular exercise along with medications for high cholesterol and blood pressure can go a long way in slowing the process of atherosclerosis. Taking care of yourself will also greatly improve your chances of getting the best possible rate when applying for life insurance.

How Can the Insurance Professionals at MEG Financial Help?

At MEG Financial, we have assisted many people with a history of atherosclerosis obtain fairly priced life insurance. Many of these clients had previously attempted to buy life insurance elsewhere and were either turned down or asked to pay a significantly higher rate. The fact is, all life insurance companies do not underwrite the same and knowing which companies will give you the “benefit of the doubt” based on your circumstances is extremely important. Our experience helping others is crucial to you in finding the life insurance company that will treat you the best.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over any questions or other concerns.

Speak with an experienced advisor!

Speak with an experienced advisor!