Quotes and Options for Life Insurance if you Have High Cholesterol

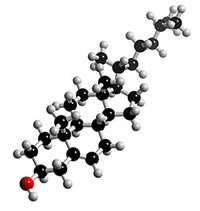

Understanding Cholesterol (Lipids)

The American Heart Association defines cholesterol as a soft, waxy substance found among the fats in the bloodstream and in the body’s cells. The body uses cholesterol to form cell membranes, some hormones and to produce bile acids needed to digest fat. It is produced naturally in the liver but is also found in high fat foods from animals such as meat, eggs, and dairy products.

While the body requires cholesterol to function properly, it only needs a small amount. Because cholesterol and other fats can’t dissolve in the blood, they have to be transported to and from the body’s cells. These transporters are called lipoproteins. The two main lipoproteins, or cholesterol carriers in the blood, are low-density lipoprotein (LDL) and high-density lipoprotein (HDL).

Other related medical conditions (or medical terminology) include High Cholesterol, Hyperlipidemia, Elevated Cholesterol, Lipids, Elevated Lipids , HDL Cholesterol, LDL Cholesterol, Arteriosclerosis, Atherosclerosis, and Coronary Artery Disease. Learn more information on receiving a term life insurance quote with these medical conditions from our life insurance specialists.

LDL Cholesterol

Low-density lipoprotein is the major cholesterol carrier in the blood. If is commonly referred to as “bad cholesterol” because if too much LDL cholesterol is present, it can slowly build up in the walls of the arteries and form hard deposits known as plaque. Once plaque builds, it can cause blockages in the arteries transporting blood to the heart or brain. This condition is known as arteriosclerosis or atherosclerosis and can lead to heart attack or stroke.

A normal LDL cholesterol level is less than 100 mg/dL.

An LDL level exceeding 160 mg/dL reflects an increased risk for heart disease.

HDL Cholesterol

High density lipoprotein is thought to carry cholesterol away from the arteries and back to the liver where it is then passed from the body. HDL cholesterol is commonly referred to as “good cholesterol” as it removes excess cholesterol from plaque and thereby slows plaque buildup in the arteries reducing the risk of atherosclerosis.

A normal HDL cholesterol level is 40 mg/dL or greater.

An HDL cholesterol level lower than 40 mg/dL increases the risk of future heart problems as well as the risk of stroke.

Cholesterol Facts and Statistics

- An estimated 105.2 million or 20% of all adults, in the United States have total blood cholesterol values of 200 mg/dL and higher, American Heart Association.

- About 36.6 million American adults have levels of 240 mg/dL or above, American Heart Association.

- High blood cholesterol is a major risk factor for heart disease.

- Cholesterol, in most cases, can be controlled with diet and exercise.

- More women over age 45 have high cholesterol than men.

- Almost 30 million prescriptions are written each year for cholesterol lowering drugs, accounting for $20 billion in annual sales for the pharmaceutical industry.

Risk Factors of High Cholesterol

Many of the risk factors associated with high cholesterol can be controlled with lifestyle changes. Life insurance companies will be especially interested in the presence of these risk factors and their potential influence on cholesterol levels.

- Eating a diet high in saturated fat or trans fatty acids.

- Inactivity or lack of exercise.

- Obesity tends to increase LDL levels and decrease HDL cholesterol.

- Smoking may also lower your level of HDL cholesterol.

- High blood pressure can damage your arteries which can speed the buildup of plaque.

- Diabetes. High blood sugar contributes to high LDL cholesterol and low HDL cholesterol.

- Family history of heart disease. If a parent or sibling who has developed heart disease before age 55, your high cholesterol levels will place you at a greater risk of developing heart disease.

If the factors above are present and your cholesterol is elevated, life insurance companies will consider you an increased risk and you can expect to pay a higher rate for life insurance.

The Impact of High Cholesterol on Life Insurance Rates

Life insurance companies consider cholesterol a major indicator of potential future heart problems and will therefore place a heavy emphasis on cholesterol readings. In fact, cholesterol levels are a part of every life insurance company’s underwriting guidelines. These guidelines are used to categorize your underwriting health class which determines your actual rate for life insurance.

Life insurance companies use 2 basic measures of cholesterol to evaluate future risk: total cholesterol and the cholesterol/HDL ratio.

Total Cholesterol is made up of LDL cholesterol, HDL cholesterol, and VLDL cholesterol (very low density lipoproteins. A desirable level of total cholesterol is less than 200 mg/dL. Total cholesterol is a primary risk factor for coronary artery disease.

Cholesterol/HDL Ratio, or cholesterol ratio, is a calculation of the total cholesterol divided by the HDL cholesterol. It is also used by life insurance companies to assess the risk of coronary artery disease. A normal cholesterol/HDL ratio is 5.0 or less. In general, the lower the cholesterol/HDL ratio the lower the risk of heart disease.

Additionally, life insurance companies will look closely at the individual LDL cholesterol and HDL cholesterol levels in evaluating the final rate you pay for life insurance.

In general, life insurance companies will view cholesterol levels as follows:

Most companies will offer a preferred plus rate (best health class) if total cholesterol is less than 200- 220 mg/dL and the cholesterol ratio is less than 5.0. Some companies allow for treatment with medications as long as the cholesterol levels fall within these limits.

Many life insurance companies will offer a preferred rate (2nd best class) if the total cholesterol level is less than 250 mg/dL and the cholesterol/HDL ratio is less than 6.0. Medications are acceptable with every company for the preferred rate as long as the numbers fall within these limits.

There are some companies they may offer preferred rates if the total cholesterol is higher than 250 mg/dL if the cholesterol/HDL is 5.5 or lower. In other words, some life insurance companies will give you additional credit for an HDL or “good” cholesterol level that exceeds the normal 40 mg/dL.

Most insurance companies will offer a standard plus rate (3rd best class) if total cholesterol is less than 280 mg/dL with a cholesterol/HDL ratio of 7.0 or lower.

A total cholesterol level of 300-350 mg/dL or less with a cholesterol/HDL ratio of 8.0 or less will likely result in standard rates (average health class) with most companies.

If your cholesterol level exceeds 350 mg/DL and your cholesterol/HDL level exceeds 9.0 you can expect to pay a rate that is at least 50% more than the standard health rate. As the total cholesterol levels and ratios increase, so do the rates you pay for life insurance.

If total cholesterol exceeds 400 mg/DL or your ratio exceeds 10.0 you have a very good chance of being postponed or declined for life insurance.

Depending on the life insurance company you are working with, you may be able to negotiate a better rate if your HDL or good cholesterol is very high or your LDL or bad cholesterol is very low.

A critical point to note is that each life insurance company has its own independent set of underwriting criteria used to evaluate the risk of high cholesterol. Some companies allow their best health class for cholesterol treatment with medications while others will not. Additionally, some companies will have more favorable cholesterol (higher) limits for their respective preferred rate classes. The key is to know which companies will treat you most favorably based on your specific circumstances.

How Can the Insurance Professionals at MEG Financial Help?

At MEG Financial, we represent over 75 of the nation’s most competitive life insurance companies and have an excellent knowledge of how each company views cholesterol levels. We have helped many individuals across the country secure the absolute best priced life insurance based on their specific cholesterol numbers. Our experience will be invaluable to you in identifying the life insurance company that will offer you the most competitive policy.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over your specific questions.

Speak with an experienced advisor!

Speak with an experienced advisor!