The discovery of osteoporosis does not usually affect a person’s insurability.

Other related medical conditions (or medical terminology) include Osteoporosis, Degenerative Bone Disease, Bone Density Problems. Read below for more information about Osteoporosis and receiving a life insurance quote from a life insurance specialist.

Cracks in Your Body’s Framework

Osteoporosis is a disease characterized by low bone mass and deterioration of bone tissue. It occurs when the body fails to form enough new bone, or when too much old bone is reabsorbed by the body. Calcium and phosphate are the two minerals that are essential for normal bone growth. As a youth, if you did not get enough calcium or if your body did not absorb enough from your diet, your bone production and bone tissues may have suffered in silence. As you age, your body may reabsorb the calcium and phosphate from the bones back into the body, which weakens bone tissue and causes bones to become brittle and fragile.

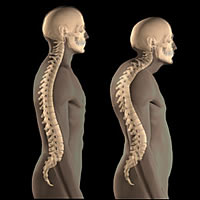

There are few symptoms of osteoporosis in its early stages for bone loss occurs silently and over the course of years. By the time osteoporosis is discovered, it is usually in advanced stages and damage is severe. Many people learn that they have the disease when they suffer a break or fracture. Some people may develop bone pain or tenderness; notice a loss of height or stooped posture or experience low back or neck pain that leads them to seek medical help. Upon examination, they may be surprised to learn that the pain is due to fractures of their spinal bones.

Does Everyone Develop Osteoporosis As They Age?

Osteoporosis is not an inevitable. Lifelong healthy habits and that include taking calcium supplements, performing weight-bearing exercise; taking hormone replacement therapy (when necessary) and eating a healthy diet (particularly foods with calcium and vitamin D) can help minimize the risk of developing osteoporosis later in life.

Hormone loss is the leading cause of osteoporosis. A drop in estrogen at the time of menopause for women or a drop in testosterone for men of the same age weakens bones. A person with a family history of the disease, extensive inactivity or bed rest, hyperthyroidism or hyperparathyroidism, who smokes cigarettes or excessively uses alcohol, is also at risk for developing osteoporosis. Individuals who have excess corticosteroid levels due to on-going use of medicines for asthma, certain forms of arthritis or skin diseases, as well as chronic pulmonary obstruction disease (COPD), are also at risk. Other factors including early menopause, absence of menstrual periods (amenorrhea), eating disorders, low body weight and too little calcium in the diet contribute to risk of developing this condition.

Before Bones Become Brittle and Break

The National Osteoporosis Foundation recommends bone mineral density testing, densitometry or DEXA scan, for all women over the age of 65 as well as for others who have risk factors for bone loss other than menopause. A CT of the spine can also reveal loss of bone mineral density as can quantitative computed tomography (QCT), but a DEXA scan is less expensive and is considered the standard for osteoporosis evaluation. Simple X-rays of bones are not the most accurate method for predicting osteoporosis, although in severe cases, they may reveal fractures or the collapse of spinal bones.

Osteoporosis and Insurability

Except in unusually severe or debilitating cases, clients with osteoporosis are usually insurable on some basis. Providing information about your bone health, using bone density scan reports and documentation of how you are able to function in daily life, will be helpful for an insurer. The health history should include date of diagnosis, injuries, falls and medications.

How Can MEG Financial Help?

At MEG Financial, we have worked with many individuals across the country that have had related histories and have helped many obtain fairly priced life insurance. A number of these clients previously attempted to buy life insurance elsewhere but were either turned down or asked to pay a significantly higher rate. Our experience helping others with related problems is invaluable to you in identifying the insurance company that will treat you most fairly.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over any questions or other concerns.

Speak with an experienced advisor!

Speak with an experienced advisor!